- This event has passed.

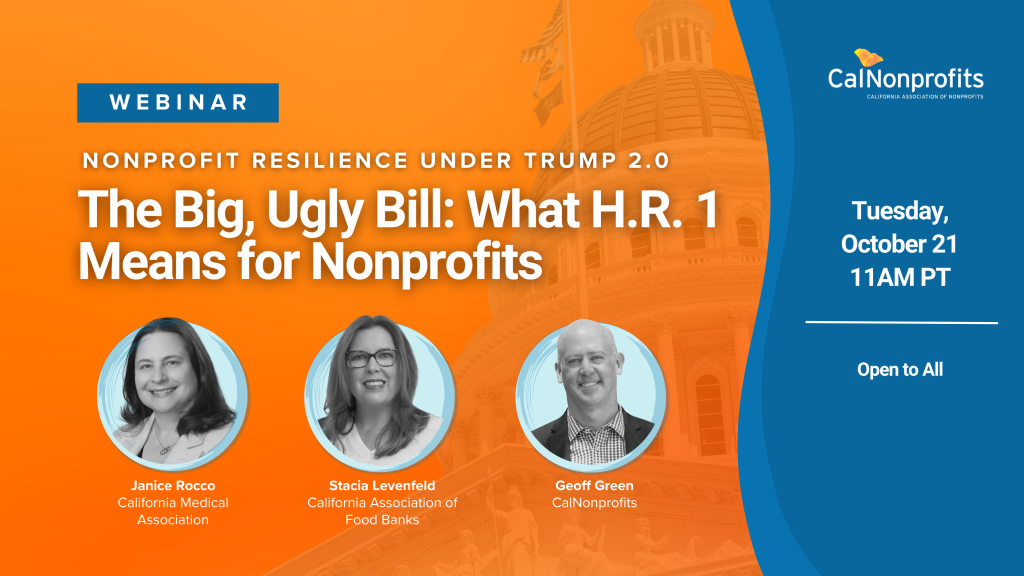

The Big, Ugly Bill: What H.R. 1 Means for Nonprofits

October 21 @ 11:00 am – 12:00 pm

The passage of H.R. 1, the so-called “One Big Beautiful Bill Act, will have far-reaching implications for the nonprofit sector. Changes to the federal tax code pose serious risks for tax-exempt organizations through new restrictions on charitable deductions, a broadened executive compensation excise tax, as well as new graduated excise taxes on foundations and university endowments. The bill will slash critical social safety net programs like Medicaid and SNAP, and represents perhaps the greatest transfer of wealth from the poor to the rich, the young to the old, and the future to the past. The Joint Committee on Taxation estimates an $81 billion reduction in nonprofit resources over the next decade.

Join us as we unpack the implications of the “One Big Beautiful Bill Act” for nonprofit organizations and help nonprofit leaders understand how H.R. 1’s budget and tax changes intersect with mission-driven work, nonprofit advocacy, and public trust in this critical moment.

We’ll explore:

● Key provisions impacting nonprofits, including changes to charitable tax rules, endowment excise taxes, and unpaid student loan forgiveness

● Shifts in Medicaid, SNAP, and funding for safety-net services that may increase demand for nonprofit programs even as resources tighten

● Why preserving the tax-exempt sector matters, and how new financial measures could affect nonprofits’ fundraising capacity

Speakers:

Geoff Green

CEO, CalNonprofits

Janice Rocco

Chief of Staff, California Medical Association

Stacia Levenfeld

CEO, California Association of Food Banks